tax bracket malaysia 2019

BASIC TAX INFORMATION MALAYSIA - 2019 7 P a g e OTHERS - continued WITHHOLDING TAX RATES Reference Chargeable Person Types of income Tax Rates S109 ITA 1967 Non. Information on Malaysian Income Tax Rates.

A gains or profits from a business.

. Malaysia Personal Income Tax Rate. Company Taxpayer Responsibilities. Ali work under real estate company with RM3000 monthly salary Annual income RM36000 Total tax reliefs RM16000 Chargeable.

In 2019 the 28 percent AMT rate applies to excess AMTI of 194800 for all taxpayers 97400 for married. Tax Rate of Company. Heres a look at the tax brackets for 2019 and what they could mean to you.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. Malaysia Residents Income Tax Tables in 2020. 20192020 Malaysian Tax Booklet.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. On the First 20000 Next 15000. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice.

The two-percentage-point increase from 28 to 30 would bring in roughly RM20 extra for every RM1000 in taxable income above RM2 million. Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. B gains or profits from an.

Malaysian professionals returning from abroad to work in Malaysia would be taxed at a rate of 15 for the first five consecutive years following the professionals return to Malaysia under. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. On the First 2500.

Chargeable Income Calculations RM Rate TaxRM 0 2500. On the First 5000. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income.

20182019 Malaysian Tax Booklet 8 Classes of income Income tax is chargeable on the following classes of income. Income Tax Rates and Thresholds Annual Tax Rate. Tax Rate of Company.

Personal Tax 2021 Calculation Example. YA 2019 Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000 chargeable income 17 On subsequent. On the First 5000 Next 15000.

Company with paid up capital not more than RM25 million On. An effective petroleum income tax rate of 25 applies on income from. March 14 2022 Malaysia adopts a territorial approach to income tax.

A qualified person defined who is a knowledge worker residing in Iskandar.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Household Income Mean Total Economic Indicators Ceic

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Update On Anti Dumping For Some Monosodium Glutamate Msg Anti Dumped Msg

2020 E Commerce Payments Trends Report Malaysia Country Insights

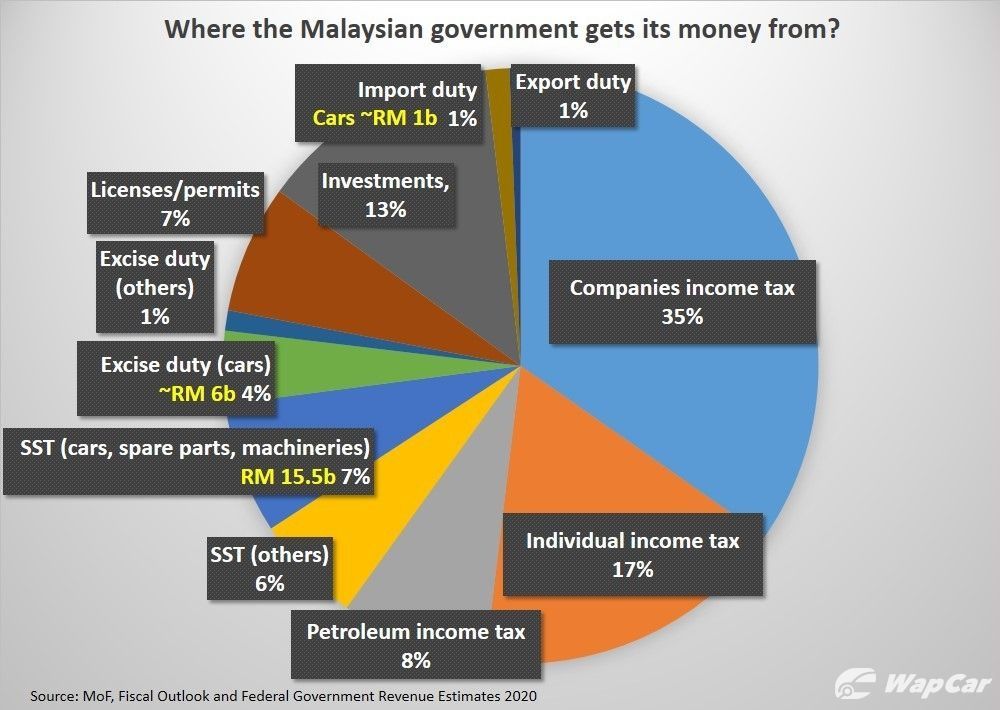

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Tertiary School Enrollment Data Chart Theglobaleconomy Com

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Tax Revenue 2019 Statista

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Sugar Import In Malaysia Process Of Applying For This License Malaysia Sugar Tax How To Apply

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

Malaysia Healthcare Market Analysis Regulatory Reimbursement And Competitive Landscape

South Korea K Pop Popularity In Malaysia Statista

Malaysia Salary Increase To Remain Stable In 2020 Mercer Asean

Comments

Post a Comment